🍲 Cooking and Real Estate: A Recipe for Connection

What do home buying and home cooking have in common? For me, real estate broker and Fort Erie local, the answer is simple: it’s about bringing people together.

Real estate is more than transactions — it’s about helping people find spaces that feel like home.

Real estate is more than transactions — it’s about helping people find spaces that feel like home.

Cooking is more than food — it’s about sharing, celebrating, and creating memories.

Cooking is more than food — it’s about sharing, celebrating, and creating memories.

I love preparing meals just as much as she loves helping families settle into the Niagara Region. From waterfront listings to food-based lifestyle tips, she shares stories that reflect what it means to live well in Fort Erie.

Follow for recipes, home tours, and stories of life on Lake Erie.

Follow for recipes, home tours, and stories of life on Lake Erie.

🛍️ Fort Erie: The Border Town Bonus for Smart Homebuyers

Why are so many GTA buyers — like Kent and Rhonda from Oakville — choosing Fort Erie?

Here’s what draws them in:

Quick access to cross-border shopping and entertainment

Quick access to cross-border shopping and entertainment Larger lots and quiet neighborhoods

Larger lots and quiet neighborhoods More house for less money

More house for less money Convenient access to Buffalo and the Peace Bridge

Convenient access to Buffalo and the Peace Bridge

Whether you’re after a turnkey home or a project property, Fort Erie offers variety — and a lifestyle that feels both relaxed and connected.

💰 Why Affordability Still Matters in the Niagara Housing Market

Even with declining prices, buyer hesitation is still high. Why?

- There’s over 9 months of inventory in the Niagara market

- Many buyers fear they’ll overpay if the market drops again

- The sheer volume of listings can be overwhelming

But here’s the truth: perfect timing rarely exists. Waiting too long can mean missing out on the best properties — or seeing rates creep back up.

But here’s the truth: perfect timing rarely exists. Waiting too long can mean missing out on the best properties — or seeing rates creep back up.

If you’re shopping in 2025, let’s cut through the noise and narrow in on what’s right for your budget, your needs, and your timeline.

🛥️ Why Buyers Are Choosing Fort Erie for a Slower Pace of Life

For many buyers in 2025, it’s not just about price per square foot — it’s about peace of mind.

More families, retirees, and professionals are looking to Fort Erie real estate for its combination of affordability and lifestyle:

Quick access to the US border

Quick access to the US border

40+ km of Lake Erie waterfront

40+ km of Lake Erie waterfront

Golf courses, nature trails, and open space

Golf courses, nature trails, and open space

Quiet neighborhoods — but close to Niagara Falls

Quiet neighborhoods — but close to Niagara Falls

Whether you’re relocating from the GTA or planning to downsize, Fort Erie offers something many urban centres can’t: breathing room.

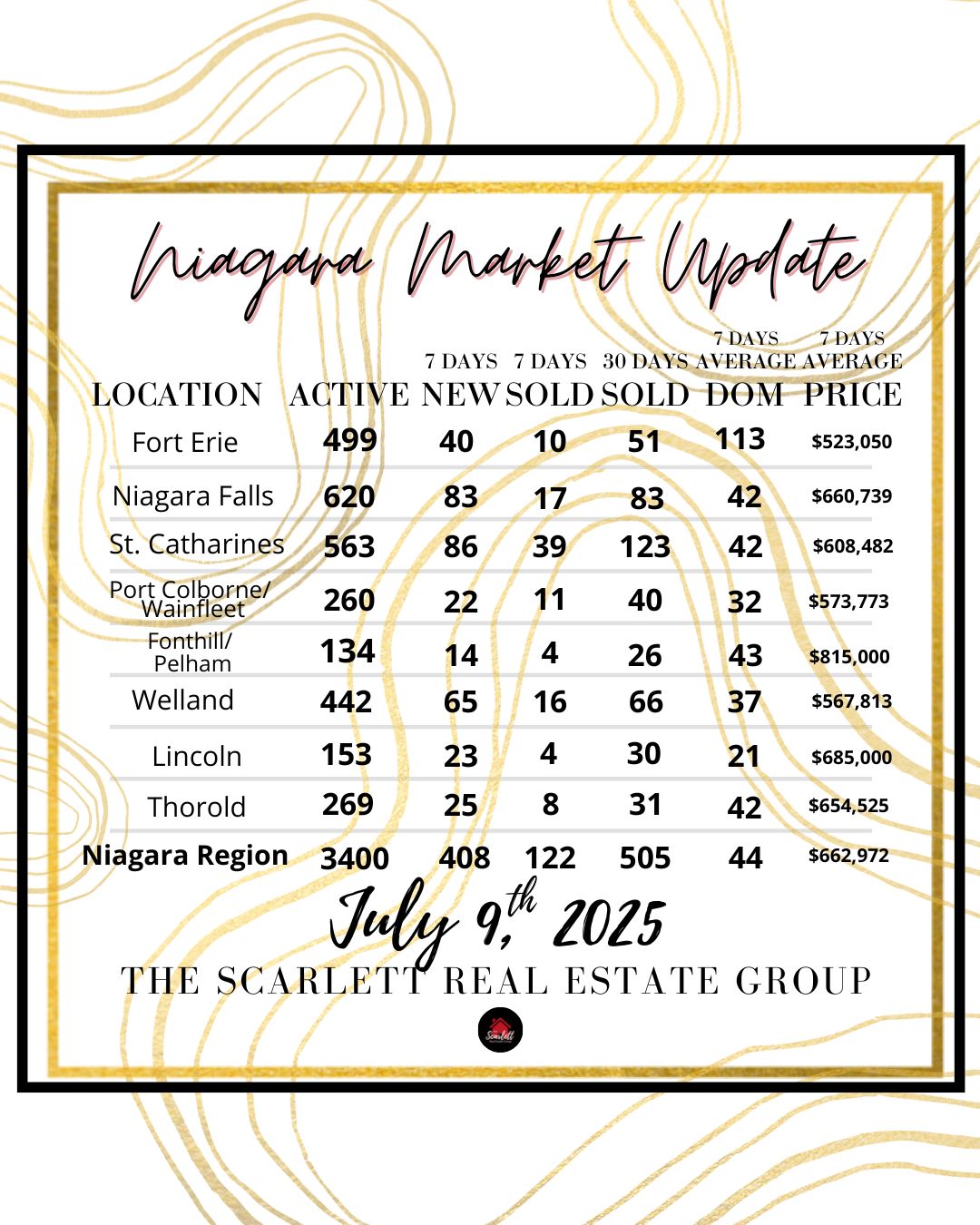

Niagara Market Pulse: July 9, 2025

The summer real estate season is in full swing, and the numbers are painting a clear picture across the Niagara Region. As of July 9th, we’re sitting on a sizable inventory—3,400 active listings region-wide—yet buyer activity remains focused and selective. With only 122 sales in the last 7 days, it’s evident that pricing, presentation, and strategy are more important than ever.

Let’s break it down.

Fort Erie saw 40 new listings and 10 sales last week, with an average price of $523,050 and a steep 113 days on market (DOM). Buyers here are cautious, and the high inventory (499 active listings) means sellers need to stand out.

Niagara Falls remains a hot spot with 83 new listings and 17 sales, averaging $660,739 and just 42 DOM. St. Catharines leads in volume, with 86 new listings and 39 sales at an average price of $608,482.

Port Colborne/Wainfleet and Welland held steady with moderate activity—11 and 16 sales respectively—while Fonthill/Pelham showed the highest average price at $815,000 despite only 4 sales.

Thorold continues to trend upward with 8 sales and a $654,525 average sale price, proving it’s still one to watch.

What does this mean for buyers and sellers?

Buyers: With rising inventory and longer DOM in many communities, there’s room to negotiate. This is your opportunity to buy smart—especially if you’re well-prepared.

Sellers: Strategy matters. Pricing competitively and investing in strong marketing (staging, photography, and exposure) is what gets homes sold in today’s market.

Have questions about your neighbourhood? Whether you’re buying, selling, or just curious—I’m always here to help decode the market and make your next move a smart one.

–

Barbara Scarlett, Broker

The Scarlett Real Estate Group – Century 21 Heritage House Ltd.

Trade Smart, Don’t Cave: Winning Tactics for Sellers

When buyers say: ‘Sharpen your pencil’ — here’s what you should say back.

Buyers often pressure sellers to drop price immediately. But instead of caving, strong negotiators look for ways to trade. Add an appliance, adjust the closing date, or offer flexibility — all without sacrificing your bottom line.

Smart trades create win-win deals that keep offers alive without leaving money on the table.

Want to negotiate like a pro? DM me — let’s talk strategy before you list.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

Quick access to cross-border shopping and entertainment

Quick access to cross-border shopping and entertainment More house for less money

More house for less money Convenient access to Buffalo and the Peace Bridge

Convenient access to Buffalo and the Peace Bridge

If you’re thinking of entering the market, let’s discuss how these numbers impact your timeline and strategy.

If you’re thinking of entering the market, let’s discuss how these numbers impact your timeline and strategy.

Based on a $100,000 household income and average debt:

Based on a $100,000 household income and average debt: Condo budget: $439,500 (includes $450 monthly maintenance fee)

Condo budget: $439,500 (includes $450 monthly maintenance fee)

100% rebate of the 5% GST for homes priced up to $1,000,000

100% rebate of the 5% GST for homes priced up to $1,000,000 Must be your primary residence

Must be your primary residence

Here are the lowest rates currently available according to Ratehub.ca:

Here are the lowest rates currently available according to Ratehub.ca: If you’re house hunting in Fort Erie, Niagara Falls, St. Catharines, or Welland, now may be the perfect time to revisit your pre-approval and lock in a favourable rate. Even a small shift in interest rates can change your monthly payment by hundreds of dollars.

If you’re house hunting in Fort Erie, Niagara Falls, St. Catharines, or Welland, now may be the perfect time to revisit your pre-approval and lock in a favourable rate. Even a small shift in interest rates can change your monthly payment by hundreds of dollars.